Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

In the U.S., consumption is about

a. | twice as volatile as GDP. | c. | three-quarters as volatile as

GDP. | b. | half as volatile as investment. | d. | as volatile as

GDP. |

|

|

|

2.

|

Let the interest rate be 6% per year. The present value in 1999 of $100 received

in 1999 and $159 received in 2000 is

a. | $250. | c. | $235. | b. | $259. | d. | $268.54. |

|

|

|

3.

|

An increase in the rate of interest will increase household saving

because

a. | it will shift the saving supply curve to the right. | b. | investment demand

will decrease. | c. | the investment demand curve will shift up and hence saving will go up in

equilibrium. | d. | it makes future consumption cheaper relative to present

consumption. |

|

|

|

4.

|

One problem with the Keynesian consumption function

is that it

a. | focuses on the motives for spending and ignores the

motives for saving. | b. | hypothesises that

decisions to save are influenced only by current income. | c. | assumes that the marginal propensity to consume is

constant. | d. | bases consumption decisions only on current

income. |

|

|

|

5.

|

According to the permanent income

hypothesis

a. | a temporary increase in income will mainly be

spent. | b. | a rise in wage rates will lead mainly to an increase in

saving. | c. | a change in disposable income will always lead to a

permanent change in consumption. | d. | a temporary fall

in wages will lead to a less than proportional reduction in

consumption. |

|

|

|

6.

|

The slope of the intertemporal budget constraint

depends on

a. | the rate of interest. | b. | the average two period level of income. | c. | income in period 1 compared with period 2. | d. | expenditure in period 1 compared with period

2. |

|

|

|

7.

|

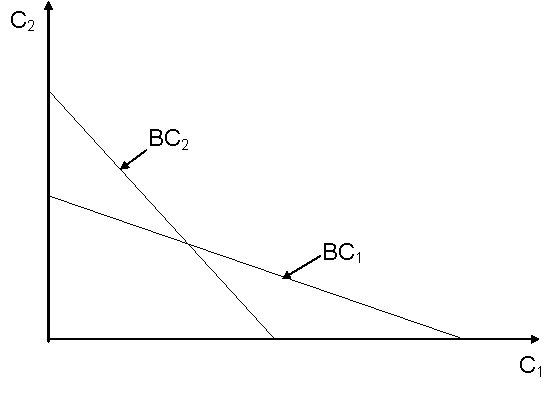

Figure 2.1 shows two budget constraints for a

consumer.

A

change in the budget constraint from BC1 to BC2 could have been caused

by

a. | a fall in interest rates for a net

borrower. | b. | a rise in interest rates for a net

borrower. | c. | a fall in interest rates for a net

saver. | d. | a rise in interest rates for a net

saver. |

|

|

|

8.

|

8.

In a two-period model of the intertemporal budget constraint, the

maximum second period consumption is such that

|