Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

The reported budget deficit refers to

a. | The debt of the federal government. | b. | Government expenditures plus transfers net of

tax revenues. | c. | Interest payments on the primary budget deficit. | d. | The primary budget

deficit plus interest payments on government debt. |

|

|

|

2.

|

If government expenditures are $11 billion, transfers are $7 billion and tax

receipts are $9 billion then the primary budget deficit is

a. | $9 billion. | b. | $5 billion. | c. | $27

billion. | d. | Cannot calculate, need figures for interest payments. |

|

|

|

3.

|

Suppose the nominal interest rate is 2% and the growth rate of GDP is 7%. If the

government maintains a policy of running a constant deficit equal to d% of GDP every year,

what is the approximate value of d consistent with a steady state value of debt equal to twice

the GDP?

|

|

|

4.

|

Ricardian Equivalence says that it does not matter whether the government

finances increased expenditure by borrowing or by raising taxes because

a. | The government must pay back its debt by borrowing more. | b. | Households correctly

anticipate that if the government borrows today, it will have to pay back the debt by raising future

taxes. | c. | Households who pay taxes are not the ones who hold government

debt. | d. | None of the above. |

|

|

|

5.

|

The national debt will rise in a particular year

when

a. | there is a budget deficit. | c. | government expenditure rises. | b. | there is a rise in interest rates. | d. | the level of

income falls. |

|

|

|

6.

|

Given the following values for consumption (C),

investment (I), government spending on goods and services (G), taxation (T) and income (Y), the

equilibrium level of income is

C = 2000 + 0.75(Y-T)

I = 1000

G = 1,500

T = 0.2Y

a. | 5,626. | c. | 11,000. | b. | 7,500. | d. | 11,250. |

|

|

|

7.

|

If, G is government spending on goods and

services, T is taxation, Y is income and c is the marginal propensity to

consume, the balanced budget multiplier can be written as

|

|

|

8.

|

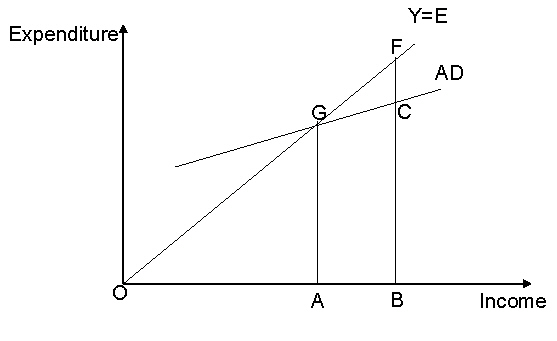

Question 8 and 9 are based on the following diagram

in which AD = C + I + G. Assume that government spending is financed entirely by borrowing and

that no taxes are levied.

8.

Which one of the above represents

savings?

|

|

|

9.

|

Which one of the above represents the level of

consumption when saving is zero?

|

|

|

10.

|

The neutrality of fiscal policy in the theory of

Ricardian equivalence has been questioned for which one of the following reasons?

a. | Consumers sometimes buy on impulse and do not plan

consumption expenditures. | b. | Lump sum taxes

have no impact of the incentive to work. | c. | Changes in the

rate of income tax impact on consumer spending. | d. | Discounting to

present value is an imprecise calculation. |

|