Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

1.

|

Assume a two-country world: Country A and Country B. Which of the following is

correct about purchasing power parity (PPP) as related to these two countries?

a. | If Country A's inflation rate exceeds Country B's inflation rate, Country

A's currency will weaken. | b. | If Country A's interest rate exceeds

Country B's inflation rate, Country A's currency will weaken. | c. | If Country A's

interest rate exceeds Country B's inflation rate, Country A's currency will

strengthen. | d. | If Country B's inflation rate exceeds Country A's inflation rate, Country

A's currency will weaken. |

|

|

|

2.

|

The international Fisher effect (IFE) suggests that:

a. | a home currency will depreciate if the current home interest rate exceeds the current

foreign interest rate. | b. | a home currency will appreciate if the current

home interest rate exceeds the current foreign interest rate. | c. | a home currency will

appreciate if the current home inflation rate exceeds the current foreign inflation

rate. | d. | a home currency will depreciate if the current home inflation rate exceeds the

current foreign inflation rate. |

|

|

|

3.

|

According to the IFE, if British interest rates exceed U.S. interest

rates:

a. | the British pound's value will remain constant. | b. | the British pound

will depreciate against the dollar. | c. | the British inflation rate will

decrease. | d. | the forward rate of the British pound will contain a premium. | e. | today's forward

rate of the British pound will equal today's spot rate. |

|

|

|

4.

|

If interest rates on the euro are consistently below U.S. interest rates, then

for the international Fisher effect (IFE) to hold:

a. | the value of the euro would often appreciate against the dollar. | b. | the value of the

euro would often depreciate against the dollar. | c. | the value of the euro would remain constant

most of the time. | d. | the value of the euro would appreciate in some

periods and depreciate in other periods, but on average have a zero rate of

appreciation. |

|

|

|

5.

|

According to the international Fisher effect, if euro investors expect a 5% rate

of domestic inflation over one year, and a 2% rate of inflation in the US, and require a 3% real

return on investments over one year, the nominal interest rate on one-year euro Treasury securities

would be:

a. | 2%. | b. | 3%. | c. | -2%. | d. | 5%. | e. | 8%. |

|

|

|

6.

|

Assume UKand Swiss investors require a real rate of return of 3%. Assume the

nominal UK interest rate is 6% and the nominal Swiss rate is 4%. According to the international

Fisher effect, the franc will _______ by about _______.

a. | appreciate; 3% | b. | appreciate; 1% | c. | depreciate;

3% | d. | depreciate; 2% | e. | appreciate; 2% |

|

|

|

7.

|

If interest rate parity holds, then the one-year forward rate of a currency will

______ the predicted spot rate of the currency in one year according to the international Fisher

effect.

a. | greater than | b. | less than | c. | equal

to | d. | answer is dependent on whether the forward rate has a discount or

premium |

|

|

|

8.

|

Assume that the inflation rate in Barbados is 3.20%, while the inflation rate in

the UK is 3.00%. According to PPP, the Barbados dollar (BBD) should ___________ by _________%.

a. | appreciate; 0.1938% | c. | appreciate; 0.1942% | b. | depreciate; 0.1938% | d. | depreciate;

0.1942% |

|

|

|

9.

|

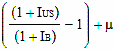

The following regression analysis was conducted for the inflation rate

information and exchange rate of the US dollar: eBP = a0 +

a1 Regression results indicate that a0

= 0 and a1 = 2. Therefore: a. | purchasing power parity holds. | b. | purchasing power parity overestimated the

exchange rate change during the period under examination. | c. | purchasing power

parity underestimated the exchange rate change during the period under

examination. | d. | purchasing power parity will overestimate the exchange rate change of the British

pound in the future. |

|

|

|

10.

|

If nominal British interest rates are 3% and nominal U.S. interest rates are 6%,

then the British pound (£) is expected to ____________ by about _________%, according to the

international Fisher effect (IFE).

a. | depreciate; 2.9 | b. | appreciate; 2.9 | c. | depreciate;

1.0 | d. | appreciate; 1.0 | e. | none of the

above |

|

|

|

11.

|

You have an opportunity to invest in Australia at an interest rate of 8%.

Moreover, you expect the Australian dollar (A$) to appreciate by 2%. Your effective return from this

investment is:

a. | 8.00%. | c. | 10.16%. | b. | 6.00%. | d. | 5.88%. |

|

|

|

12.

|

Research indicates that deviations from purchasing power parity (PPP) are

reduced over the long run.

|