True/False

Indicate whether the

sentence or statement is true or false.

|

|

|

1.

|

In general, a tax raises the price the buyers pay,

lowers the price the sellers receive, and reduces the quantity sold.

|

|

|

2.

|

If a tax is placed on a good and it reduces the

quantity sold, there must be a deadweight loss from the tax.

|

|

|

3.

|

Deadweight loss is the reduction in consumer

surplus that results from a tax.

|

|

|

4.

|

When a tax is placed on a good, the revenue the

government collects is exactly equal to the loss of consumer and producer surplus from the

tax.

|

|

|

5.

|

If John values having his hair cut at €20 and

Mary's cost of providing the hair cut is €10, any tax on hair cuts larger than €10

will eliminate the gains from trade and cause a €20 loss of total surplus.

|

|

|

6.

|

If a tax is placed on a good in a market where

supply is perfectly inelastic, there is no deadweight loss and the sellers bear the entire burden of

the tax.

|

|

|

7.

|

A tax on cigarettes would likely generate a larger

deadweight loss than a tax on luxury boats.

|

|

|

8.

|

A tax will generate a greater deadweight loss if

supply and demand are inelastic.

|

|

|

9.

|

A tax causes a deadweight loss because it

eliminates some of the potential gains from trade.

|

|

|

10.

|

A larger tax always generates more tax

revenue.

|

|

|

11.

|

A larger tax always generates a larger deadweight

loss.

|

|

|

12.

|

If an income tax rate is high enough, a reduction

in the tax rate could increase tax revenue.

|

|

|

13.

|

A tax collected from buyers generates a smaller

deadweight loss than a tax collected from sellers.

|

|

|

14.

|

If a tax is doubled, the deadweight loss from the

tax more than doubles.

|

|

|

15.

|

A deadweight loss results when a tax causes market

participants to fail to produce and consume units on which the benefits to the buyers exceeded the

costs to the sellers.

|

Multiple Choice

Identify the

letter of the choice that best completes the statement or answers the question.

|

|

|

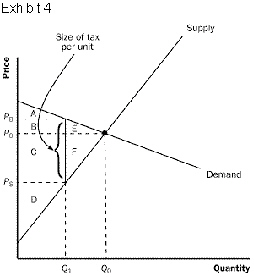

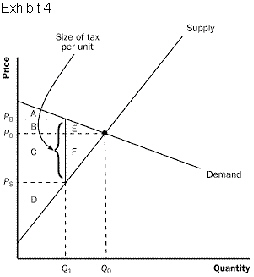

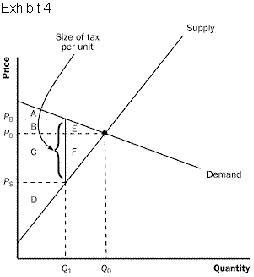

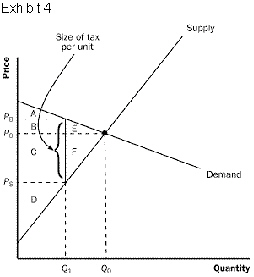

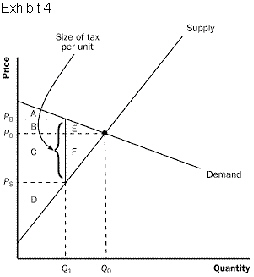

16.

|

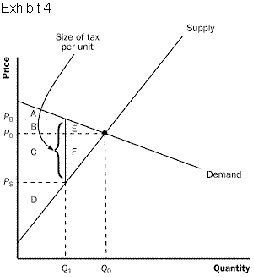

Refer to Exhibit 4. If there is no tax placed on

the product in this market, consumer surplus is the area

a. | C + D + F. | b. | A. | c. | A + B +

E. | d. | D + C + B. | e. | A + B + C. |

|

|

|

17.

|

Refer to Exhibit 4. If there is no tax placed on

the product in this market, producer surplus is the area

a. | A + B + E. | b. | D. | c. | C +

F. | d. | A + B + C + D. | e. | C + D + F. |

|

|

|

18.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, consumer surplus is the area

a. | D. | b. | A. | c. | A + B +

E. | d. | A + B + C + D. | e. | A + B. |

|

|

|

19.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, producer surplus is the area

a. | A + B + E. | b. | A + B + C + D. | c. | A. | d. | D. | e. | C + D +

F. |

|

|

|

20.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, tax revenue paid by the buyers is the area

a. | B + C + E + F. | b. | B. | c. | B +

C. | d. | A. | e. | C. |

|

|

|

21.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, tax revenue paid by the sellers is the area

a. | C + F. | b. | A. | c. | B. | d. | B + C + E +

F. | e. | C. |

|

|

|

22.

|

Refer to Exhibit 4. If there is no tax placed on

the product in this market, total surplus is the area

a. | B + C + E + F. | b. | E + F. | c. | A + B + C +

D. | d. | A + B + C + D + E + F. | e. | A + D + E + F. |

|

|

|

23.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, total surplus is the area

a. | A + B + C + D + E + F. | b. | A + B + C + D. | c. | A +

D. | d. | B + C + E + F. | e. | E + F. |

|

|

|

24.

|

Refer to Exhibit 4. If a tax is placed on the

product in this market, deadweight loss is the area

a. | B + C + E + F. | b. | E + F. | c. | B +

C. | d. | A + B + C + D. | e. | A + D. |

|

|

|

25.

|

Refer to Exhibit 4. Which of the following is true

with regard to the burden of the tax in Exhibit 4?

a. | The buyers pay a larger portion of the tax because

demand is more inelastic than supply. | b. | The sellers pay a

larger portion of the tax because supply is more elastic than demand. | c. | The buyers pay a larger portion of the tax because demand is more elastic than

supply. | d. | The sellers pay a larger portion of the tax because

supply is more inelastic than demand. |

|

|

|

26.

|

Which of the following would likely cause the

greatest deadweight loss?

a. | a tax on salt | b. | a tax on cigarettes | c. | a tax on

petrol | d. | a tax on cruise line

tickets |

|

|

|

27.

|

A tax on petrol is likely to

a. | generate a deadweight loss that is unaffected by the

time period over which it is measured. | b. | cause a greater

deadweight loss in the long run when compared to the short run. | c. | none of these answers | d. | cause a greater

deadweight loss in the short run when compared to the long

run. |

|

|

|

28.

|

Deadweight loss is greatest when

a. | supply is elastic and demand is perfectly

inelastic. | b. | demand is elastic

and supply is perfectly inelastic. | c. | both supply and

demand are relatively inelastic. | d. | both supply and

demand are relatively elastic. |

|

|

|

29.

|

Since the supply of undeveloped land is relatively

inelastic, a tax on undeveloped land would generate

a. | a small deadweight loss and the burden of the tax would

fall on the renter. | b. | a large deadweight

loss and the burden of the tax would fall on the landlord. | c. | a large deadweight loss and the burden of the tax would fall on the

renter. | d. | a small deadweight loss and the burden of the tax would

fall on the landlord. |

|

|

|

30.

|

Which of the following is true with regard to a tax

on labour income? Taxes on labour income tend to encourage

a. | the unscrupulous to enter the underground

economy. | b. | the elderly to retire early. | c. | all of the things described in these answers. | d. | second earners to stay home. | e. | workers to work fewer hours. |

|

|

|

31.

|

When a tax on a good starts small and is gradually

increased, tax revenue

a. | will fall. | b. | will rise. | c. | will first rise

and then fall. | d. | will first fall

and then rise. | e. | none of these

answers |

|

|

|

32.

|

The graph that shows the relationship between the

size of a tax and the tax revenue collected by the government is known as a

a. | none of these answers | b. | Reagan curve. | c. | Keynesian

curve. | d. | Laffer curve. | e. | Henry George curve. |

|

|

|

33.

|

If a tax on a good is doubled, the deadweight loss

from the tax

a. | doubles. | b. | stays the same. | c. | increases by a

factor of four. | d. | could rise or

fall. |

|

|

|

34.

|

The reduction of a tax

a. | will have no impact on tax

revenue. | b. | will always reduce tax revenue regardless of the prior

size of the tax. | c. | could increase tax

revenue if the tax had been extremely high. | d. | causes a market to

become less efficient. |

|

|

|

35.

|

When a tax distorts incentives to buyers and

sellers so that fewer goods are produced and sold than otherwise, the tax has

a. | caused a deadweight loss. | b. | decreased equity. | c. | generated no tax

revenue. | d. | increased

efficiency. |

|