True/False

Indicate whether the

statement is true or false.

|

|

|

1.

|

The largest source of revenue for the UK government is personal income

tax.

|

|

|

2.

|

An excise tax is a tax on income.

|

|

|

3.

|

Expenditure on national defence is an example of a government transfer

payment.

|

|

|

4.

|

To judge the vertical equity of a tax system, one should look at the average tax

rate of taxpayers of differing income levels.

|

|

|

5.

|

The marginal tax rate is the appropriate tax rate to judge how much a particular

tax system distorts economic decision making.

|

|

|

6.

|

A lump-sum tax is a progressive tax.

|

|

|

7.

|

Lump-sum taxes are equitable but not efficient.

|

|

|

8.

|

An efficient tax is one that generates minimal deadweight losses and minimal

administrative burdens.

|

|

|

9.

|

The personal income tax system in the United Kingdom is regressive.

|

|

|

10.

|

Corporations bear the burden of corporation tax.

|

|

|

11.

|

A tax system with a low marginal tax rate generates less deadweight loss and is

more efficient than a similar tax system with a higher marginal tax rate.

|

|

|

12.

|

If the government runs a budget deficit, it means that there is an excess of

government spending over government receipts.

|

|

|

13.

|

Reducing tax rates can lead to an increase in tax revenue for a

government.

|

|

|

14.

|

The marginal tax rate is total taxes paid divided by total income.

|

|

|

15.

|

The chief advantage of replacing personal income tax with a consumption tax is

that it would remove the disincentive to saving that arises from the levying of personal income tax

on income from savings.

|

Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

16.

|

Which of the following lists the sources of tax revenue to the UK government

from the largest source to the smallest source?

a. | national insurance contributions, personal income tax, value added

tax. | b. | personal income tax, national insurance contributions, value added

tax. | c. | personal income tax, value added tax, national insurance

contributions. | d. | value added tax, personal income tax, national insurance

contributions. |

|

|

|

17.

|

In the United Kingdom, the tax system is

a. | lump sum. | c. | progressive. | b. | regressive. | d. | proportional. |

|

|

|

18.

|

In 2008-09, the total amount of taxes levied in the UK was equivalent to around

which of the following for every man, woman and child in the country (to the nearest thousand)

a. | £5,000. | b. | £6,000. | c. | £7,000. | d. | £8,000. | e. | £9,000. |

|

|

|

19.

|

Which of the following lists the spending by the UK government from the largest

category to the smallest category?

a. | defence, National Health Service, Social Security, education, transport, pubic order

and safety. | b. | Social Security, defence, National Health Service, transport, pubic order and

safety. | c. | Social Security, National Health Service, education, defence, pubic order and safety,

transport. | d. | National Health Service, defence, education, Social Security, transport, pubic order

and safety. |

|

|

|

20.

|

If the German government runs a budget surplus, there is

a. | an excess of government receipts over government spending. | b. | an equality of

government spending and receipts. | c. | a surplus of government

workers. | d. | an excess of government spending over government

receipts. |

|

|

|

21.

|

Heike values a pair of blue jeans at €40. If the price is €35, Heike

buys the jeans and generates consumer surplus of €5. Suppose a tax is placed on blue jeans that

causes the price of blue jeans to rise to €45. Now Heike chooses not to buy a pair of jeans.

This example has demonstrated

a. | the deadweight loss from a tax. | b. | the ability-to-pay

principle. | c. | the benefits principle. | d. | horizontal equity. | e. | the administrative

burden of a tax. |

|

|

|

22.

|

A tax for which high income taxpayers pay a smaller fraction of their income

than do low income taxpayers is known as

a. | a proportional tax. | c. | an equitable tax. | b. | a regressive tax. | d. | a progressive

tax. |

|

|

|

23.

|

An efficient tax

a. | minimizes the administrative burden from the tax. | b. | does all of the

things described in these answers. | c. | raises revenue at the smallest possible cost to

taxpayers. | d. | minimizes the deadweight loss from the tax. |

|

|

|

24.

|

The marginal tax rate is

a. | the taxes paid by the marginal worker. | b. | total income divided by total taxes

paid. | c. | the extra taxes paid on an additional unit of income. | d. | total taxes paid

divided by total income. |

|

|

|

25.

|

The appropriate tax rate to consider to judge the vertical equity of a tax

system is the

a. | marginal tax rate. | c. | horizontal tax rate. | b. | average tax rate. | d. | proportional tax

rate. |

|

|

|

26.

|

The average tax rate is

a. | total taxes paid divided by total income. | b. | the extra taxes paid

on an additional dollar of income. | c. | the taxes paid by the marginal

worker. | d. | total income divided by total taxes paid. |

|

|

|

27.

|

Which of the following taxes is the most efficient tax?

a. | a consumption tax | c. | a progressive income tax | b. | a lump-sum

tax | d. | a proportional income

tax |

|

|

|

28.

|

A progressive tax system is one where

a. | marginal tax rates are high. | b. | higher income taxpayers pay more taxes than do

lower income taxpayers. | c. | marginal tax rates are low. | d. | higher income

taxpayers pay a greater percentage of their income in taxes than do lower income

taxpayers. |

|

|

|

29.

|

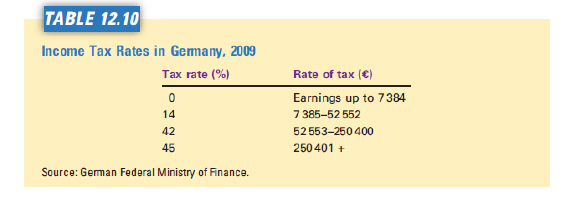

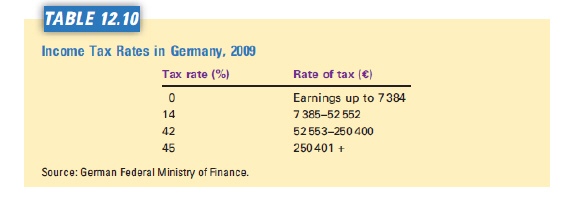

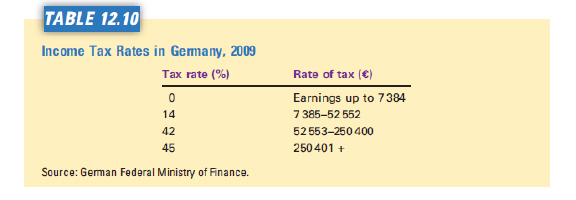

Refer to Table 12.10. The average tax rate for a German taxpayer earning

€40,000 (rounded up) is  a. | 0 percent. | b. | 5 per cent | c. | 7 per

cent | d. | 12 per cent | e. | 14 per cent |

|

|

|

30.

|

Refer to Table 12.10. This tax system is  a. | regressive. | c. | lump-sum. | b. | proportional. | d. | progressive |

|

|

|

31.

|

Refer to Table 12.10. The marginal tax rate for a taxpayer whose earnings rises

from €50,000 to €60,000 is  a. | 0 percent. | b. | 50 percent. | c. | 100

percent. | d. | 150 percent. | e. | 200 per cent |

|

|

|

32.

|

The ability-to-pay principle of taxation suggests that if a tax system is to be

vertically equitable, it should be

a. | efficient. | b. | progressive. | c. | regressive. | d. | proportional. | e. | lump-sum. |

|

|

|

33.

|

Which of the following taxes can be supported by the benefits principle of

taxation?

a. | All of these answers can be supported by the benefits principle of

taxation. | b. | progressive income taxes used to pay for national defence | c. | petrol taxes used to

pay for roads | d. | property taxes used to pay for police and the court system | e. | progressive income

taxes used to pay for antipoverty programs |

|

|

|

34.

|

The appropriate tax rate to consider to gauge how much the tax system distorts

incentives and decision making is the

a. | proportional tax rate. | b. | average tax rate. | c. | marginal tax

rate. | d. | vertical tax rate. | e. | horizontal tax

rate. |

|

|

|

35.

|

A tax system is regarded as horizontally equitable if

a. | all taxpayers pay the same amount of tax | b. | taxes on all goods

are levied at the same rate | c. | taxes are as low as

possible | d. | the system comprises only lump sum taxes | e. | taxpayers with

similar abilities to pay taxes pay the same amount |

|