True/False

Indicate whether the

statement is true or false.

|

|

|

1.

|

In general, a tax raises the price the buyers pay, lowers the price the sellers

receive, and reduces the quantity sold.

|

|

|

2.

|

If a tax is placed on a good and it reduces the quantity sold, there must be a

deadweight loss from the tax.

|

|

|

3.

|

Deadweight loss is the reduction in consumer surplus that results from a

tax.

|

|

|

4.

|

When a tax is placed on a good, the revenue the government collects is exactly

equal to the loss of consumer and producer surplus from the tax.

|

|

|

5.

|

If Stefan values having his hair cut at €20 and Magda’s cost of

providing the hair cut is €10, any tax on hair cuts larger than €10 will eliminate the

gains from trade and cause a €20 loss of total surplus.

|

|

|

6.

|

If a tax is placed on a good in a market where supply is perfectly inelastic,

there is no deadweight loss and the sellers bear the entire burden of the tax.

|

|

|

7.

|

A tax on cigarettes would likely generate a larger deadweight loss than a tax on

luxury boats.

|

|

|

8.

|

A tax will generate a greater deadweight loss if supply and demand are

inelastic.

|

|

|

9.

|

A tax causes a deadweight loss because it eliminates some of the potential gains

from trade.

|

|

|

10.

|

A larger tax always generates more tax revenue.

|

|

|

11.

|

A larger tax always generates a larger deadweight loss.

|

|

|

12.

|

If an income tax rate is high enough, a reduction in the tax rate could increase

tax revenue.

|

|

|

13.

|

A tax collected from buyers generates a smaller deadweight loss than a tax

collected from sellers.

|

|

|

14.

|

If a tax is doubled, the deadweight loss from the tax more than doubles.

|

|

|

15.

|

A deadweight loss results when a tax causes market participants to fail to

produce and consume units on which the benefits to the buyers exceeded the costs to the

sellers.

|

Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

16.

|

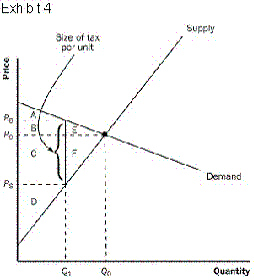

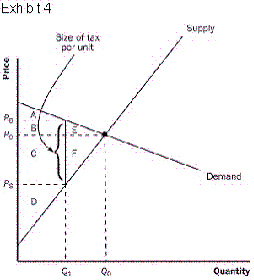

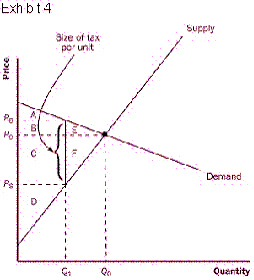

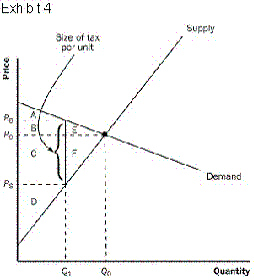

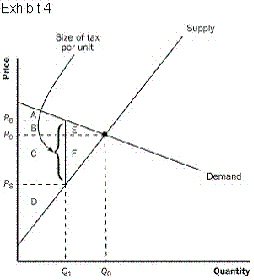

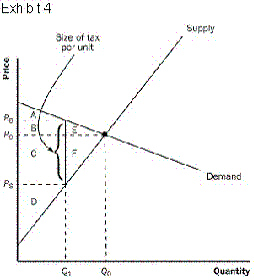

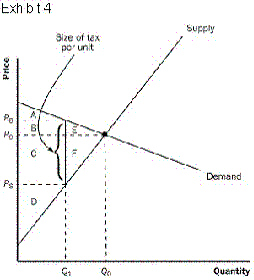

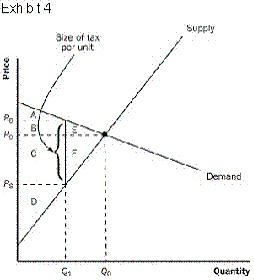

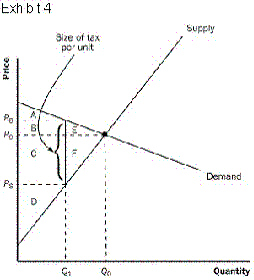

Refer to Exhibit 4. If there is no tax placed on the product in this market,

consumer surplus is the  a. | Area C + D + F | b. | Area A | c. | Area A + B +

E | d. | Area D + C + B | e. | Area A + B + C |

|

|

|

17.

|

Refer to Exhibit 4. If there is no tax placed on the product in this market,

producer surplus is the  a. | Area A + B + E | b. | Area D | c. | Area C +

F | d. | Area A + B + C + D | e. | Area C + D + F |

|

|

|

18.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, consumer

surplus is the  a. | Area D | b. | Area A | c. | Area A + B +

E | d. | Area A + B + C + D | e. | Area A + B |

|

|

|

19.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, producer

surplus is the  a. | Area A + B + E | b. | Area A + B + C + D | c. | Area

A | d. | Area D | e. | Area C + D + F |

|

|

|

20.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, tax

revenue paid by the buyers is the  a. | Area B + C + E + F | b. | Area B | c. | Area B +

C | d. | Area A | e. | Area C |

|

|

|

21.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, tax

revenue paid by the sellers is the  a. | Area C + F | b. | Area A | c. | Area

B | d. | Area B + C + E + F | e. | Area C |

|

|

|

22.

|

Refer to Exhibit 4. If there is no tax placed on the product in this market,

total surplus is the  a. | Area B + C + E + F | b. | Area E + F | c. | Area A + B + C +

D | d. | Area A + B + C + D + E + F | e. | Area A + D + E +

F |

|

|

|

23.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, total

surplus is the  a. | Area A + B + C + D + E + F | b. | Area A + B + C + D | c. | Area A +

D | d. | Area B + C + E + F | e. | Area E + F |

|

|

|

24.

|

Refer to Exhibit 4. If a tax is placed on the product in this market, deadweight

loss is the  a. | Area B + C + E + F | b. | Area E + F | c. | Area B +

C | d. | Area A + B + C + D | e. | Area A + D |

|

|

|

25.

|

Refer to Exhibit 4. Which of the following is true with regard to the burden of

the tax in Exhibit 4?  a. | The buyers pay a larger portion of the tax because demand is more inelastic than

supply. | b. | The sellers pay a larger portion of the tax because supply is more elastic than

demand. | c. | The buyers pay a larger portion of the tax because demand is more elastic than

supply. | d. | The sellers pay a larger portion of the tax because supply is more inelastic than

demand. |

|

|

|

26.

|

Which of the following would likely cause the greatest deadweight loss?

a. | a tax on salt | c. | a tax on petrol | b. | a tax on cigarettes | d. | a tax on cruise line

tickets |

|

|

|

27.

|

A tax on petrol is likely to

a. | generate a deadweight loss that is unaffected by the time period over which it is

measured. | b. | cause a greater deadweight loss in the long run when compared to the short

run. | c. | not generate any deadweight loss because petrol is a necessity | d. | cause a greater

deadweight loss in the short run when compared to the long run. |

|

|

|

28.

|

Deadweight loss is greatest when

a. | supply is elastic and demand is perfectly inelastic. | b. | demand is elastic

and supply is perfectly inelastic. | c. | both supply and demand are relatively

inelastic. | d. | both supply and demand are relatively elastic. |

|

|

|

29.

|

Since the supply of undeveloped land is relatively inelastic, a tax on

undeveloped land would generate

a. | a small deadweight loss and the burden of the tax would fall on the

renter. | b. | a large deadweight loss and the burden of the tax would fall on the

landlord. | c. | a large deadweight loss and the burden of the tax would fall on the

renter. | d. | a small deadweight loss and the burden of the tax would fall on the

landlord. |

|

|

|

30.

|

Which of the following is true with regard to a tax on labour income? Taxes on

labour income tend to encourage

a. | the unscrupulous to enter the underground economy. | b. | the elderly to

retire early. | c. | all of the things described in these answers. | d. | second earners to

stay home. | e. | workers to work fewer hours. |

|

|

|

31.

|

When a tax on a good starts small and is gradually increased, tax revenue

will

a. | fall. | b. | rise. | c. | first rise and then

fall. | d. | first fall and then rise. | e. | not change at

all |

|

|

|

32.

|

The graph that shows the relationship between the size of a tax and the tax

revenue collected by the government is known as a

a. | Friedman conjecture | b. | Reagan curve. | c. | Keynesian

curve. | d. | Laffer curve. | e. | Chicago school

curve. |

|

|

|

33.

|

If a tax on a good is doubled, the deadweight loss from the tax

a. | doubles. | c. | increases by a factor of four. | b. | stays the

same. | d. | could rise or

fall. |

|

|

|

34.

|

The reduction of a tax

a. | will have no impact on tax revenue. | b. | will always reduce tax revenue regardless of

the prior size of the tax. | c. | could increase tax revenue if the tax had been

extremely high. | d. | causes a market to become less efficient. |

|

|

|

35.

|

When a tax distorts incentives to buyers and sellers so that fewer goods are

produced and sold than otherwise, the tax has

a. | caused a deadweight loss. | c. | generated no tax

revenue. | b. | decreased equity. | d. | increased efficiency. |

|